J.P. Morgan Special: Dealmaker of the Year 2023 (Part 02)

Shots:

-

In the next installment of Dealmaker 2023, we bring an informative report on the Top M&A based on the Deal Value

-

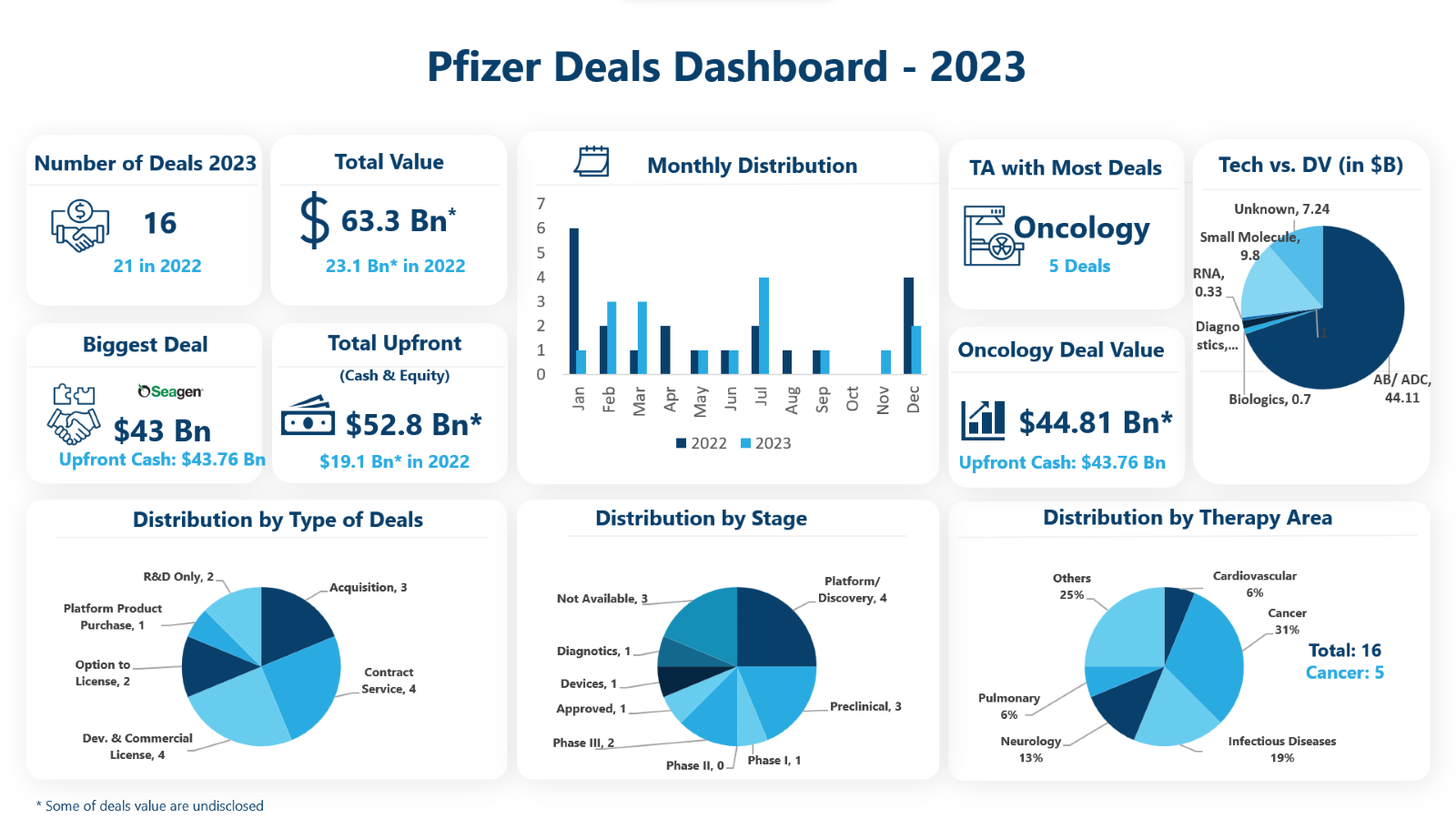

The report revolves around Pfizer, which signed 16 collaborations comprising acquisitions, contract services, development & commercialization, license, R&D, and product purchases that have summed to a total of $63.23B

-

Propelled by the invaluable insights from DealForma, PharmaShots brings an on-demand report on the Dealmaker of the Year 2023

Summary:

Owing to the economic downturn and the existing regulatory environment, the overall volume of biopharma deals and their value in 2023 witnessed a fluctuating dip, as compared to 2022. Based on data till Q3, Economists believe that the slump can be persistent throughout 2024 due to anticipated rate cuts by the Federal Reserve.

PharmaShots brings a condensed report on the Dealmaker of the Year, 2023, by utilizing DealForma's ardent and continuous analysis of the major biopharma deals. The report on Dealmaker of the Year is compiled based on two criteria and is divided into two-part, Part 1 is based on the Highest Number of Deals Signed, and Part 2 is based on the Highest Amount of Total Deal Value

In 2023, the top dealmakers based on the total generated disclosed total deal values were Pfizer ($63.23B), Merck ($44.28B), AbbVie ($22.64B), Roche ($21.85B), Eli Lilly ($15.24B). As Pfizer ranked number one in the list of dealmakers, PharmaShots compiled the top highlights from Pfizer’s 2023 dealmaking.

A multinational healthcare firm, Pfizer is a renowned name in the biopharma industry and was ranked number 1 among the Top 20 Biopharma Companies of 2022. Pfizer generated a total revenue of $100.33B in 2022. The company divides its business into segments across three broad customer groups: Primary Care, Specialty Care, and Oncology. The company's primary focus is on the discovery, development, production, and marketing of therapeutics and vaccines in Oncology, Immunology, Cardiology, Neurology, and Endocrinology, among other therapeutic areas.

In 2023, Pfizer made 16 transactions with key investments made to companies for deals including development and commercialization (n=4) and acquisitions (n=3) among others. In 2023, the highest transaction made by Pfizer remained the acquisition of Seagen for an aggregate of $43B. Other than Seagen, Pfizer also acquired Cerevel Therapeutics and Lucira Health. Out of the 16 transactions made, the company disclosed the value for 11, which has summed up to an aggregate of $63.23B, ranking Pfizer at the top among the major dealmakers in 2023.

Insights:

-

In 2022, Pfizer had 21 signed transactions that summed to a total of $23.1B, whereas throughout 2023, the company indulged in only 16 deals, but the value summed to $63.3B, depicting a 174% increase

-

January was the most productive month for Pfizer in 2022 but in 2023, July turned out to be the most productive

-

In 2023, Pfizer signed the maximum number of deals relating to Development, Commercialization, and Contract Services

-

Oncology was the highest priority indication for Pfizer in 2023, similar to the previous year

-

In 2023, the acquisition of Seagen remained the biggest deal signed by Pfizer worth $43B

Top Deals of Amgen

1. Pfizer to Acquire Seagen for ~$43B

Total Deal Value: $43B

Shots:

-

Pfizer will acquire Seagen for $229/per share in cash representing a total enterprise value of $43B while Seagen expects ~$2.2B of revenue in 2023 from its four in-line therapies & bringing Pfizer $10B+ in risk-adjusted revenues by 2030. The transaction is expected to be completed in late 2023 or early 2024

-

The acquisition will combine Seagen’s ADC technology with Pfizer’s capabilities & expertise to bring new solutions to patients & also advance Seagen’s ADC technology to unlock novel target combinations & next-generation biologics

-

Seagen’s portfolio incl. 4 approved medicines across solid tumors & hematologic malignancies, incl. 3 ADCs: Adcetris, Padcev & Tivdak. It also has a pipeline of drugs under development that incl. treatments for lung cancer & advanced breast cancer

Total Deal Value: $1.1B

Shots:

-

Nona Biosciences has agreed to sign an exclusive license agreement with Pfizer to advance its Harbour Mice platform & the ADC ecosystem and to also enhance its global network of collaboration with an expectation to amplify the scientific and commercial value of its technology platforms

-

Under the terms of the agreement, Nona Biosciences will receive an aggregate of $53M as up front & near-term payments in addition to $1.05B in potential development & commercialization milestones plus tiered royalties

-

HBM9033 is an ADC drug developed by Nona Biosciences to specifically target human MSLN, a tumor-associated antigen, and is derived from the Nona’s Harbour Mice platform

3. Biohaven Acquires Rights for BHV-8000 to Treat Immune-Mediated Brain Disorders

Total Deal Value: $970M

Shots:

-

Highlightll will receive $10M up front in cash, $10M in BHVN equity & ~$950M in development & commercial milestones along with royalty. Both companies will coordinate the clinical development across global regions

-

Biohaven obtains global rights (Ex-China) for the development of BHV-8000, a highly selective, brain-penetrant, dual TYK2/JAK1 inhibitor to treat brain disorders

-

Biohaven continues to advance BHV-8000 (previously TLL-041) licensed from Highlightll into a P-I study in 2023. In comparison to less selective or non-selective JAK inhibitors, BHV-8000 has been shown to have high selectivity over JAK2, JAK3, & other kinases potentially providing improved safety. In preclinical models, mechanistic PoC for BHV-8000 has been established

Total Deal Value: $704M

Shots:

-

The companies expand their collaboration for the long-term commercial manufacturing of Pfizer’s multi-product portfolio, based on an initial manufacturing agreement signed in Mar 2023 for a specific Pfizer product

-

Samsung Biologics will provide Pfizer with additional capacity for large-scale manufacturing for a multi-product biosimilars portfolio covering oncology, inflammation, and immunology & uses its newest facility, Plant 4, for the manufacturing

-

Additionally, Pfizer continues to partner with Samsung Biologics to provide better treatment options for patients globally

5. Ginkgo Bioworks Collaborated with Pfizer to Discover RNA-Based Drug Candidates

Total Deal Value: $331M

Shots:

-

Ginkgo will receive an up front and is eligible to receive research fees, development, and commercial milestones of ~$331M across 3 programs along with royalties on sales

-

The collaboration will use Ginkgo's RNA technology to advance the discovery & development of novel RNA molecules across priority research areas. The technology combines high-throughput screening of the behaviour of RNA constructs with a multi-parameter design framework for the identification of novel natural and synthetic elements optimal for a particular application

-

Pfizer will identify new RNA constructs that can improve stability & expression to create new therapies. Ginkgo aims to achieve efficient production, circularization, improved stability & enhanced translation of RNA constructs

Disclaimer:

-

PharmaShots has not included Clinical Trial Agreements and Joint Ventures

Related Post: JP Morgan Special: Deal Maker of the Year 2023 (Part 01)

Tags

Shivani is a content writer at PharmaShots. She has a keen interest in recent innovations in the life sciences industry. She covers news related to Product approvals, clinical trial results, and updates. She can be contacted at connect@pharmashots.com.